With Advantage Customs and SAP

Create, manage, and send confirmation of receipt

We have our customs software  Extend Customs adds a feature that allows you to easily create, send, manage, and admonish receipts. Depending on your requirements, we provide you with the function as a SAP plug-in or interface for integration into your system landscape.

Extend Customs adds a feature that allows you to easily create, send, manage, and admonish receipts. Depending on your requirements, we provide you with the function as a SAP plug-in or interface for integration into your system landscape.

Functionality

Entry confirmations can be generated directly from Advantage Customs or SAP.

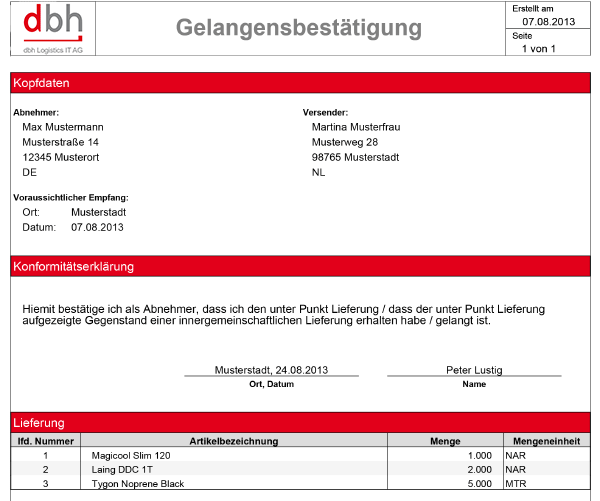

For each manually collected or generated data, a PDF document (GB document) is created for delivery to the recipient.

This PDF document contains the data of the shipment (sender, customer, date, goods data) the frame data of the transaction (operation number, date, recipient e-mail address,…).

Your benefits

- Compliance with the statutory proof obligations (UStD) including VAT ID verification

- Transparent status display

- Full integration with Advantage Customs or SAP

- High flexibility with regard to pre-documents

- Audit-proof document storage

- Accelerated processing at the customer’s

Automating processes

By using e-mail and the GB portal, you can automate and simplify your processes.

By using e-mail and the GB portal, you can automate and simplify your processes.

A confirmation request will be sent to the recipient by e-mail. The mail contains:

- a link to the GB portal (“Quick-Link”) where the customer confirms or refuses to enter,

- information on framework data and the call for confirmation.

The receipt document can be downloaded via the Quick link in the entry confirmation portal.

VAT ID check

Our additional function to ensure that you continue to comply with the requirements for VAT-exempt intra-Community deliveries:

- Daily task check

- Simple VAT ID queries via the database of the Federal Central Tax Office (BZSt) of all foreign VAT Ids

- Presentation of requests and responses in the receipt process

- Archiving of electronically acknowledged results for confirmation of entry

- Search function and status tracking

- Change history

Are you interested?

Full flexibility – no matter if individual or collective confirmation

It is up to you whether you wish to submit confirmations for each transport individually or to submit quarterly summary confirmations. The legislator accepts both options.

- VAT ID No. Testing

- Creating entry confirmations

- Management and monitoring of entry confirmations

- Reading in-depth confirmations

- Status management and status tracking

- Adjustable reminder functions for unconfirmed entry confirmations

- Master data management of business partners

- Multilingual capability (German, English, French, other languages on request)

- Production of individual or collective confirmations

- Archiving of electronically acknowledged receipts

- Search and print function

Is a confirmation of entry mandatory?

The confirmation of entry (GB) came after intensive discussions and a change in the VAT Implementation Ordinance (in accordance with Section 17a UStDV), as of 01.10.2013. Since then, confirmations of entry are regarded, among other things, as proof of all modes of transport. And there is no question of dealing with the obligation to provide proof of VAT exemption for intra-European transport.

Background knowledge for confirmation of entry

The confirmation of entry was introduced on 01.01.2012 and was intended to replace the existing proof. However, there were numerous protests from the business community, which led to a new regulation of the controversial version of the underlying VAT implementing regulation. Since the cut-off date, 01.10.2013, the confirmation of entry has been regarded as proof of all modes of transport in the case of intra-Community deliveries. Alternatively, proofs are possible if third parties, such as freight forwarders, are involved in the transport process.

Your contact to dbh

You have a question?

You have a question? Then write us via our contact form.

Your contact to our sales department

Your contact to the dbh sales department

+49 421 30902-700 or sales@dbh.de

You are interested in our products and consulting or need help with your dbh software? Our sales team will advise you to find the perfect solution for your company.