Making strategic use of customs advantages

Many companies associate customs with terms such as cumbersome, time-consuming and costly. But that is only one aspect of the topic. What many do not know: Profitability within the supply chain is not just a question of freight costs or purchase prices. The potential savings in customs regulations are considerable. Neglecting them means missing out on interesting opportunities in supply chain management. Especially in the current situation, however, even the smallest details matter when it comes to optimizing costs. Systematically reviewing all options can ultimately lead to tangible competitive advantages – by using customs procedures with economic significance or relevant free trade agreements.

Your solution for all customs benefits

Mit unserer Zollsoftware Advantage Customs können Sie alle Zollvorteile einfach in einer Software nutzen. Informieren Sie sich über den vollen Funktionsumfang gleich hier.

Customs procedures with economic significance

Customs procedures become economically relevant when they open up financial structuring opportunities for companies when they are applied. This is the case when customs duties on goods do not arise at all – or only when they enter the economic cycle of the own country or the customs union. Customs procedures with economic impact include: inward and outward processing, temporary admission and customs warehouse.

All customs procedures with economic significance have one criterion in common: they can only be used after prior approval by the competent customs authority. So be sure to apply for the appropriate permit in a timely manner.

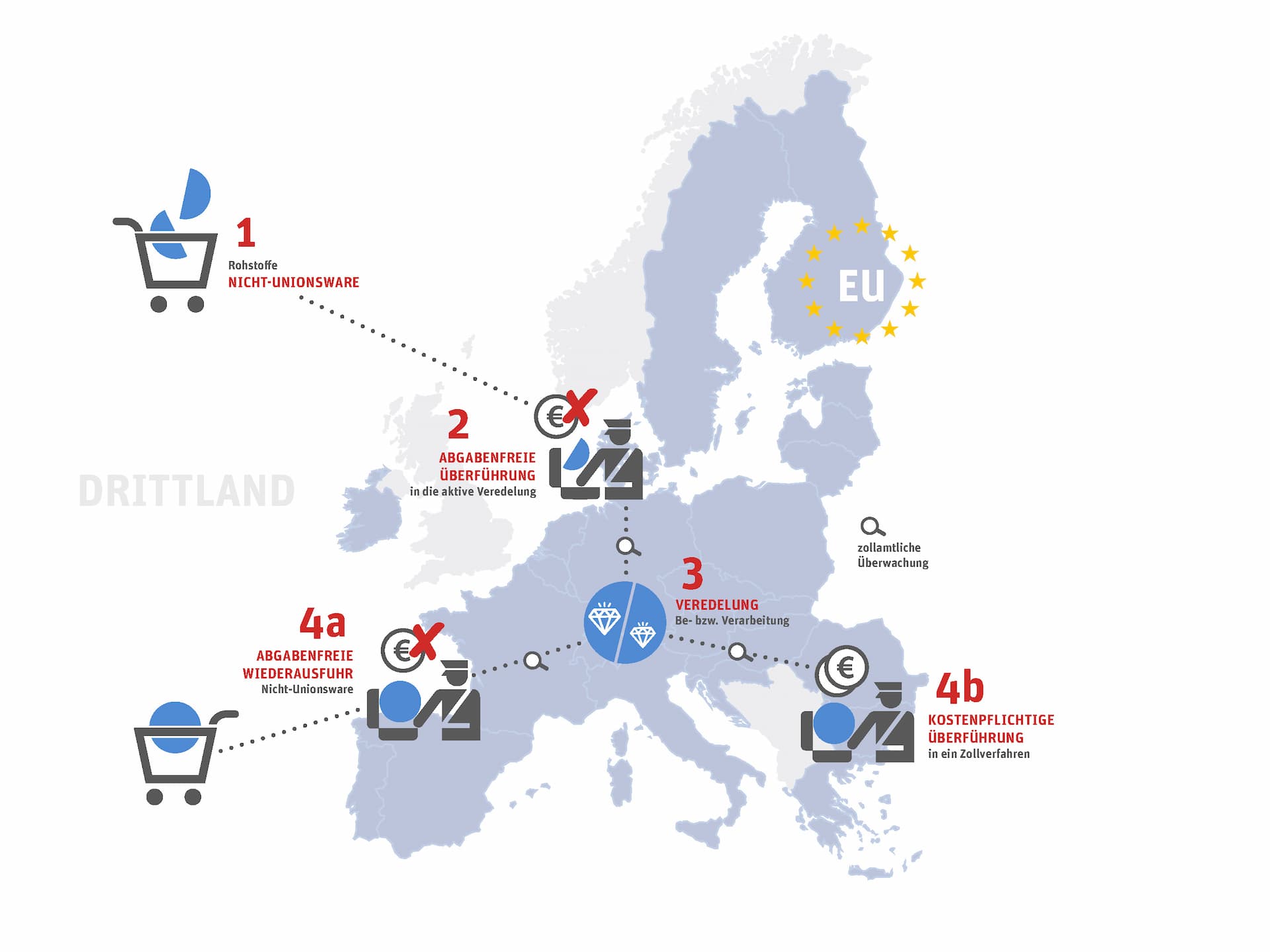

Inward processing: Savings through exports

The term inward processing describes goods from countries outside the EU that undergo so-called processing operations within the European Union. This can be, for example, the assembly from delivered parts or the repair of goods.

Inward-processed goods are not subject to import duties or other charges and trade policy measures. The procedure enables you to process goods from outside the EU within the European customs territory free of customs duty, without it being definitively determined whether the goods will subsequently be placed on the market in the EU or re-exported. Inward processing grants you a customs duty reduction when you use input materials for a final product that leaves the EU again. Example: You import individual parts from an Asian country to Germany, assemble them into a machine here in Germany, and export the finished product to South America. In this case, you do not have to pay import duties. Import duties are only levied when the previously imported input materials flow into the economic cycle of the EU.

A special case of inward processing is the destruction of imported goods. In this case, too, no import duties are levied.

Incidentally, in the case of re-export of inward-processed goods, it does not matter whether the goods return to the same country from which they were imported. The only important thing is that they do not remain within the EU. Only then do the associated customs benefits apply. The procedure serves to promote the competitiveness of domestic companies and is thus intended to facilitate the sale of goods manufactured in Germany in third countries.

Outward Processing: Exploiting Cost Advantages in Third Countries

From an economic point of view, outward processing involves outsourcing working or processing operations to lower-cost foreign countries. In contrast to inward processing, Union goods are exported from the customs territory of the EU and re-imported in processed form.

Why can savings be made here? On the one hand, of course, through the possibly more favorable costs in the third country. On the other hand, it is not the processed product itself that is subject to duty, but only the added value created by the further processing in the third country. For example, crabs from the North Sea are exported in their shells and harvested abroad to be reimported afterwards. Duty is paid on the pickling abroad and the transportation costs.

The customs classification of the goods is of importance here. Divergent opinions may well arise here. Therefore, it is advisable in any case to check the existing classification and adjust it if necessary. This can not only lead to noticeable cost savings because a different customs value calculation is applied depending on the commodity code, but the correct commodity code also leads to correct origin determination and withstands customs audits, for example.

A special case of outward processing is the temporary export of goods in connection with a legal or contractual warranty obligation or in the context of the elimination of a functional or production defect. If the services are provided free of charge, no customs duties are payable on re-importation.

Outward processing is designed to enable companies to take advantage of low labor costs in third countries outside the EU to manufacture their products.

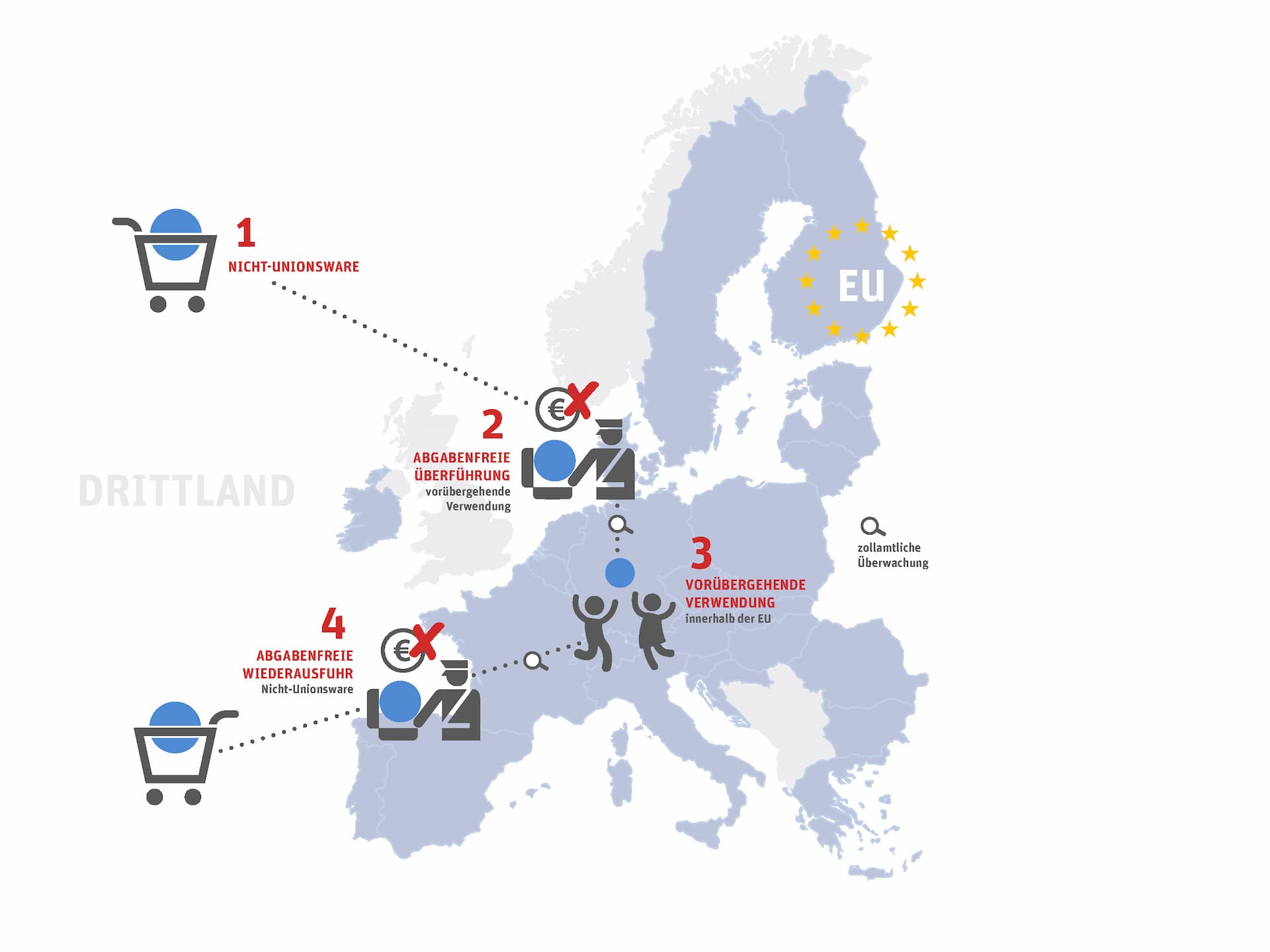

Temporary use

The temporary admission customs procedure deals with the fact that import duties are to be levied only on those goods from countries outside the EU that remain permanently in the EU customs territory and become part of the economic cycle here.

If goods are used only temporarily in the customs territory and then re-exported, no duties are incurred on the use of temporary admission. A typical use case would be, for example, the use of non-European goods at trade fairs within the EU, professional equipment used or test goods.

No customs duties are levied on goods under the customs procedure and no other trade policy measures are applied. In this context, the scope of the benefits is also subject to the type of use, the category of goods and the duration of stay within the EU. In some cases, a limited benefit may be granted, namely if certain interests of the EU economy are affected.

However, the use of the temporary admission customs procedure is only permitted if no modification (repair, processing) is made to the goods and the goods are re-exported in their unmodified state. Compliance with the guidelines is subject to customs supervision. In addition, the identity of the goods must be secured to ensure that the goods being re-exported are identical to the imported goods.

There is a maximum limit of two years for the duration of use. During use, conversion to regular importation for permanent retention is also possible. In this case, payment of regular import duties will then be due.

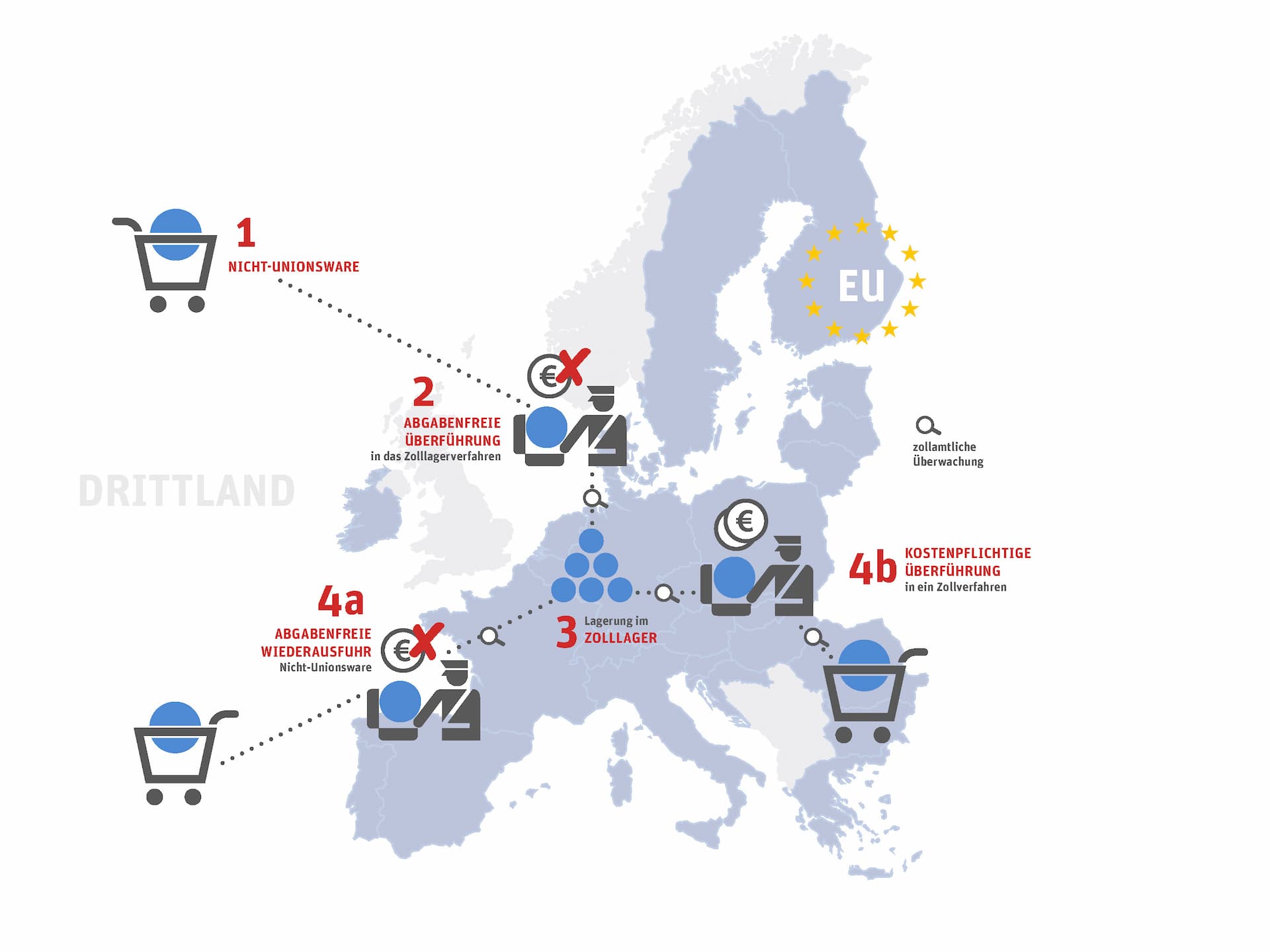

Bonded warehouse: source of liquidity for companies

The use of a bonded warehouse can provide your company with a noticeable relief of its own liquidity reserves. However, there are some limiting factors to consider. First, however, the question arises: What exactly is a bonded warehouse?

The term bonded warehouse describes a physically separated area in which non-Union goods can be stored untaxed and duty unpaid. This can be, for example, a separate warehouse on the premises of the company. However, other segregated areas such as open spaces, tanks or silos that have been declared to customs can also be used as bonded warehouses. Smaller companies that do not have the floor space to maintain their own bonded warehouse usually use bonded warehouse space maintained and offered by freight forwarders.

The liquidity advantage of a bonded warehouse results from the savings in customs duty as long as the goods are in the warehouse. The savings are made in two places: First, ultimately only the goods that remain in the EU are actually cleared through customs. On the other hand, the duty is only due when the goods are removed from the customs warehouse.

By deferring the payment of duties and taxes until the time you ultimately remove the goods from bonded warehouses and release them into free circulation, a credit effect is created. At the same time, the money remains available to your business while it remains in bonded warehouses, so there is also a cash flow benefit for you.

Another way to achieve liquidity advantages is to grant a current payment deferral. If you have set up an appropriate deferral account, this makes it possible to delay payment of customs duties on the 16th of the following month after clearance.

Placement in a bonded warehouse is particularly suitable for goods that will be re-exported from the EU after storage, because you do not have to pay duties for them. Example: If you had normally released the goods for free circulation when importing them and paid the import duties due for them, you would now have to pay duty again on the goods when they are delivered to Switzerland or Russia. By using the customs warehousing procedure, you save customs costs in this case. In addition, a preference can also be used if necessary. If, for example, Chinese origin goods can be imported into Switzerland at a reduced rate of duty under the China/Switzerland agreement.

Since there is no restriction on the storage period, the bonded warehouse is particularly interesting for you if the final destination of the goods is not yet clear at the time of import.

At the same time, the goods in the bonded warehouse are also free from the application of trade policy measures (e.g. the submission of import licenses or the consideration of quotas) for the duration of storage.

Disadvantage of the bonded warehouse: its use is usually associated with some administrative work. For example, the procedure requires prior approval from the relevant main customs office and, in many cases, a security deposit. It is also important to take into account: in the distinction from inward processing, no further production or further treatment with added value is allowed in the bonded warehouse. Only the treatment of goods to maintain the quality such as airing, dusting, ironing textiles, packing and unpacking are allowed.

Proof of origin – complex topic with savings potential

Among the most complex issues in the customs clearance of non-EU goods are proofs of origin, which are an essential part of determining the amount of duty. The complexity of establishing proofs of origin arises in two places: on the one hand, due to the composition of goods from components originating from both within and outside the EU, and on the other hand, due to an increasingly complex multilateral web of agreements.

In recent years, the number of free trade and economic agreements concluded with the EU has increased noticeably. This is a welcome development, as it opens up the possibility for you to import goods from third countries duty-free or at reduced tariffs.

Export to countries with such agreements is also easier and takes place under preferential conditions. Use these advantages, you achieve a competitive advantage over other suppliers.

However, trade advantages on import and export only come into play if the goods can prove so-called preferential EU origin. This proof can be complicated in certain cases, but is worthwhile given the benefits that can be achieved. The use of appropriate software systems is advisable in order to keep the sometimes high workload within reasonable bounds. However, digitization makes it easy to channel the sometimes overflowing volumes of data and process them in a reasonable amount of time.

Warenursprung & Präferenzen

With our solutions for origin of goods and preferences, you can take advantage of the customs benefits from trade agreements

The problem with proving the EU origin of a good lies in the fact that in many cases this does not apply to the whole good, but only to parts of it. In particular, when using components that originate from suppliers outside the EU, it must be possible to prove that the goods as a whole still originate preferentially from the EU.

To make matters even more complicated: Supplier parts may themselves contain parts that originate from sub-suppliers outside the EU. Since these can also be made up of parts from other suppliers, the evaluation can be very time-consuming.

The evaluation of whether a product has preferential EU origin is carried out in the preference calculation. For this purpose, it is necessary to determine and evaluate certain origin characteristics and rules of origin.

The process requires the accurate classification of all precursors and that of the final product. For the exact clarification of the origin characteristics, a daily updated maintenance of the master data and the supplier declarations is essential. For example, changes in the price of input products or the final product may require a completely new calculation. A change of supplier also necessitates a new calculation, since his parts may themselves have a different calculation.

Preference costing can also have a direct impact on product costing. For example, this case may occur: It changes the supplier of a component because of the more favorable price of this supplier. However, unlike the previous supplier, the part does not have preferential EU origin. This worsens the calculation of the whole final product, so that it no longer has EU origin and an increased or normal duty is levied. The resulting disadvantage can cancel out or even exceed the cost advantage of switching suppliers.

Of fundamental importance is the correct indication of origin in the supplier’s declaration. If there are deviations or inaccuracies here, this can lead to the withdrawal of a preference certificate that has already been issued, which can result in massive subsequent customs clearance. Irregularities may also be construed as participation in tax evasion. In addition, there are possible claims for compensation by buyers if they suffer damage as a result of incorrect information provided by the seller.

Here’s what you should keep in mind with your proof of origin

The preparation of a preferential EU proof of origin is a holistic process that involves the entire company. Production, purchasing, sales, finance, research, development – they all have to do their part to make costing possible. This is supplemented by up-to-date information on components, raw materials and markets. Therefore, you should consider or pay attention to:

- Which trade agreements apply to the relevant products in your range when importing and exporting?

- What are the requirements? This includes the determination of the export destination country, the origin characteristics for supplier parts, correct material and parts lists, product classification and a comprehensible preference calculation.

- Which rules affect which product?

- How can a functioning flow control be implemented for the original costing? How must the documentation be designed?

- How can an efficient coordination of all involved divisions be set in motion?

- Which departments or teams are responsible for ongoing monitoring of global trade (for example, exchange rates, legislation, and other factors that can affect costing)?

- Which departments or teams are responsible for taking action when there are product changes, supplier changes, or changes in tariffs or legislation?

- Which software for collecting, processing and forwarding data and documents should be used? This includes the areas of assignment of customs tariff numbers and export control numbers, classification, obtaining, renewing, archiving and validating supplier declarations, calculation of origin and management of preferential certificates of origin.

Per software to conserve resources

In particular, the use of preference software can have a massive impact on efficiency, cost savings and conservation of the company’s own resources. Their use not only reduces administrative costs, but also minimizes customs duties and transportation costs.

The great advantage of digitized costing is that it can be almost completely automated, which has a particularly favorable effect on the cost situation, personnel deployment and productivity. The data-based calculation also increases legal certainty due to the low error rate.

However, blind faith in digital calculation is not an ideal approach either. Automatic processes also require regular monitoring. And this can only succeed if the employees involved undergo regular training and develop the necessary sensitivity to the complex issue.

Your contact to dbh

You have a question?

Sie können uns direkt über unser Kontaktformular erreichen.

You are interested in our products?

Sie nutzen eines unserer Produkte und benötigen Unterstützung? Unser Support-Team berät Sie gerne.