FAQ: Getting fit for WUP

Many companies have supplier declarations issued as proof of preference in order to take advantage of customs concessions and thus create a competitive advantage for themselves. Often there are some questions at the beginning of this topic, which we are happy to answer here.

What is changed by the Union Customs Code

The Union Customs Code entered into force on May, 1st 2016. There were not only changes in customs clearance – there were also innovations in the areas of supplier declarations, origin of goods and preference calculation. Among other things, the period for issuing long-term supplier’s declarations has changed and the issuing of replacement preference documents has been extended. We have compiled the most important facts about the Union Customs Code for you.

Preferences

What are preferential agreements?

The European Community/European Union has concluded so-called preferential agreements with a number of countries or groups of countries (e.g. the EFTA states, the Balkan countries, but also Mexico, Chile, South Africa, South Korea). In these preferential agreements, tariff concessions (preferences) were agreed. This means that imports into a country with which such an agreement has been concluded can be made duty free or at least at a reduced rate of duty. The goods must meet certain rules of origin laid down in the preferential agreement.

Information on the valid preferential agreements and the respective rules of origin can be found on the customs website of the Federal Ministry of Finance (BMF).

Why do I save customs duties through preferential agreements?

Preferential agreements between the European Union and a whole range of third countries and trade areas provide for significant tariff concessions. As an exporting company, you can offer your customer in the receiving country very favourable import conditions – but you also have a high outlay.

In order to benefit from these discounts, you must prove the origin of the goods for each item produce Given the scope and number of agreements and the fact that you need valid supplier’s declarations for as many items as possible, this is not an easy task.

Which software is suitable for supplier declarations and preference calculation?

The administration of supplier master data as well as incoming and outgoing individual and long-term supplier declarations makes a suitable software absolutely necessary. We offer you such software with Advantage Compliance Präferenzmanagement.

We are happy to answer your questions about the use of the software in your company. Please use the form on the right of the page to contact us.

Origin of goods

What is hidden behind the term "Origin of goods"?

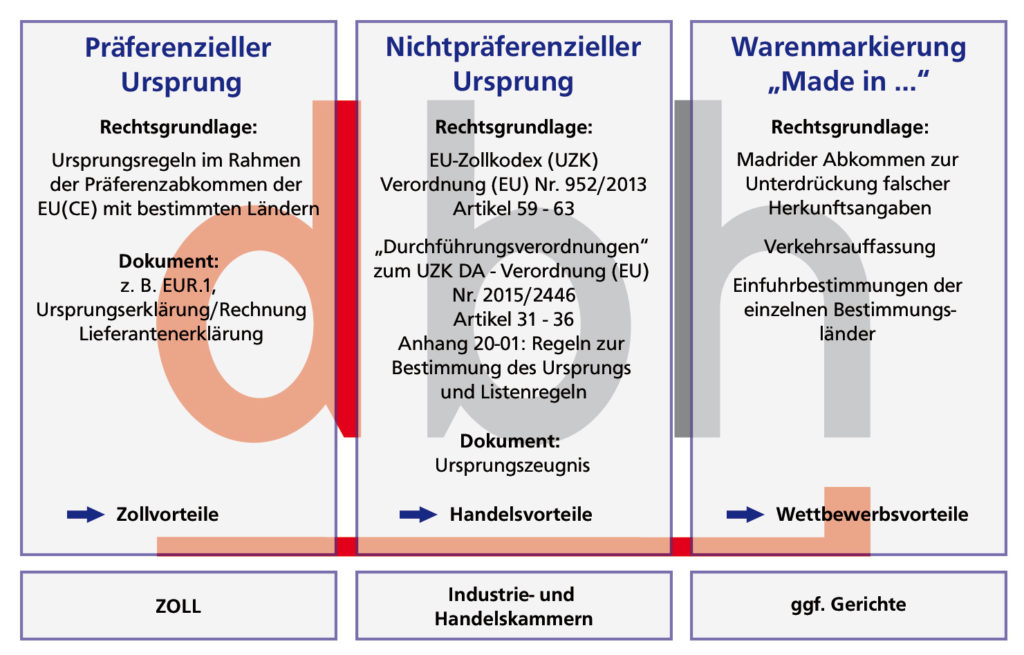

What is the preferential origin?

The European Union has concluded unilateral or bilateral preferential agreements with individual states or groups of states. Under unilateral agreements, preferential originating products can be imported into the European Union at reduced or zero duty. In the case of bilateral agreements, the import in the respective agreement state, e.g. Switzerland, is also duty reduced or duty free.

An essential condition for this is that the rules of working and processing set out in the Agreement in relation to the goods concerned are complied with. Only if these are fulfilled may supplier’s declarations be issued within the European Union with preferential origin and when exporting to the respective agreement state EUR.1 /EUR-MED. Also, the declaration of origin on the invoice is only allowed if the respective rule is fulfilled.

The application of these agreements is voluntary and there is no customs constraint.

However, its application is necessary for many companies for competition law reasons, especially as the number of agreements concluded is constantly increasing. Every company should carefully analyse the costs and benefits of this topic and take into account that comprehensive expertise is required.

What is the non-preferential origin?

Non-preferential origin is also known as ‘commercial origin’. The basis for determining non-preferential origin is the Union Customs Code. The origin of the product is where the essential working or processing of the product has taken place. In a company set up for this purpose and with the aim of manufacturing a new product or reaching a significant production stage.

Many countries require a so-called certificate of origin when importing goods for trade policy reasons (control of flows of goods, anti-dumping measures). This document is also frequently required in documentary credit business. In Germany the Chambers of Industry and Commerce (IHK) are responsible for the exhibition. The assessment of where the essential working and processing of the product has taken place is also carried out by the relevant Chamber of Industry and Commerce.

What does "Made in Germany" mean?

The marking of goods with “Made in Germany” serves consumer protection. The traffic perception in the respective industry forms the basis for determining the origin. There is therefore no legal basis for determining origin. In the event of a dispute, an assessment is made by a court.

Supplier declaration

What is a supplier declaration and what is its purpose?

A supplier’s declaration for goods having preferential originating status is a declaration concerning the preferential origin of goods. A supplier’s declaration serves as proof to an exporter when requesting or making out a proof of preference (movement certificate EUR.1, EUR-MED or origin declaration on the invoice). A supplier’s declaration explains to the customer for which future export transactions the delivered goods are entitled to preferential treatment.

Obligation to verify preferential proofs

If the exporter requests proof of preferential origin, he is responsible for the accuracy of his information on the preferential origin of the goods. It is therefore obliged to verify and document the preferential origin of the goods in accordance with the rules of origin laid down in the preferential agreement between the European Community/European Union and the importing country concerned. This examination covers all goods which he intends to export, i.e. both goods which he has worked or processed in his own factory in the EC and purely commercial goods. To facilitate this verification, the exporter may ask his suppliers to provide supplier’s declarations in accordance with Articles 61 to 65 of the Implementing Regulation (EU) 2015/2447 of the Union Customs Code as evidence of the preferential origin of the goods they supply.

What is the advantage of a supplier's declaration and what duties of care are involved?

The advantage of a supplier’s declaration is that it can be issued by the company on its own responsibility and without official involvement. However, this circumstance also results in special duties of care. The customs authorities may verify the accuracy of a supplier’s declaration at any time and may request any necessary supporting evidence. This includes the production of an information sheet INF 4, which the supplier must apply for at his competent customs office.

What should be formally observed when issuing a supplier's declaration?

The legal basis for issuing a supplier’s declaration is Articles 61 to 66 of Implementing Regulation (EU) 2015/2447 of the Union Customs Code. The Regulation makes the wording of supplier’s declarations binding. As the indication of the Regulation number is not mandatory and the wording of supplier’s declarations for goods having preferential originating status does not change, it is generally possible to issue supplier’s declarations without indicating the Regulation number.

Country designations in supplier declarations

When indicating the countries to which the supplier’s declaration applies, both the official country names and the two-character ISO alpha codes may be used. Collective designations such as “EFTA” or “CEEC” are not permitted, nor is the designation “EC” for the European Community. As there is no ISO country code for the EC and confusion with Egypt is sometimes assumed, the EC should either be tendered as “European Community” or abbreviated for example as EEC, CEE or CE. The abbreviation EU is also accepted as well as “European Union”. Supplier’s declarations can also be issued retrospectively, i.e. they must be accepted even if they are issued after a delivery has already been made. Since 1 May 2016, long-term supplier’s declarations can be issued retrospectively for a maximum of 1 year from the date of issue.

What is the purpose of a long-term supplier declaration?

When a supplier regularly supplies a particular buyer with goods whose preferential origin is unlikely to change in the long term, he may issue a “long-term supplier’s declaration”. A long-term supplier’s declaration is a unique declaration which covers subsequent shipments of the same goods and is valid for a maximum period of two years. The start of the validity period depends on the date of issue of the long-term supplier’s declaration.

Information sheet: How to fill in a supplier's declaration correctly

We have compiled further information on the subject of origin of goods and preferences (WUP) as well as instructions for completing the supplier’s declaration in the following document.

Where can I find forms and forms for supplier's declarations?

There are currently no standard forms for individual supplier’s declarations or long-term supplier’s declarations. Nach Artikel 61 bis 66 der Durchführungsverordnung (EU) 2015/2447 sind deren Wortlaute für Warenlieferungen innerhalb der Gemeinschaft sowie für grenzüberschreitende Warenlieferungen definiert. You can find the texts on the customs website of the Federal Ministry of Finance (www.zoll.de)

Do you have any more questions? No prob!

Are there any questions left unanswered? No problem: send us your questions support@dbh.de

Your contact to dbh

You have a question?

You have a question? Then write to us via our contact form.

Your contact to our sales department

Your contact to the dbh sales department

+49 421 30902-700 or sales@dbh.de

Do you use one of our products and need support? Our support team will be happy to advise you.