Modern customs clearance

Um am internationalen Handel teilzunehmen, ist eine effiziente und kosteneffektive Zollabwicklung unabdingbar. Die Digitalisierung der Zollverfahren vereinfacht die Abwicklung von Import- und Exportprozessen. Vorausgesetzt, man hat die richtige Software, um alle schriftlichen Zollanmeldungen und Verwaltungsakte durch elektronische Nachrichten zu ersetzen. Mit Advantage Customs von dbh lassen wird die Zollabfertigung und Zollsachbearbeitung effizienter, schneller und rentabler.

Den Überblick im Dschungel der Zollvorschriften behalten

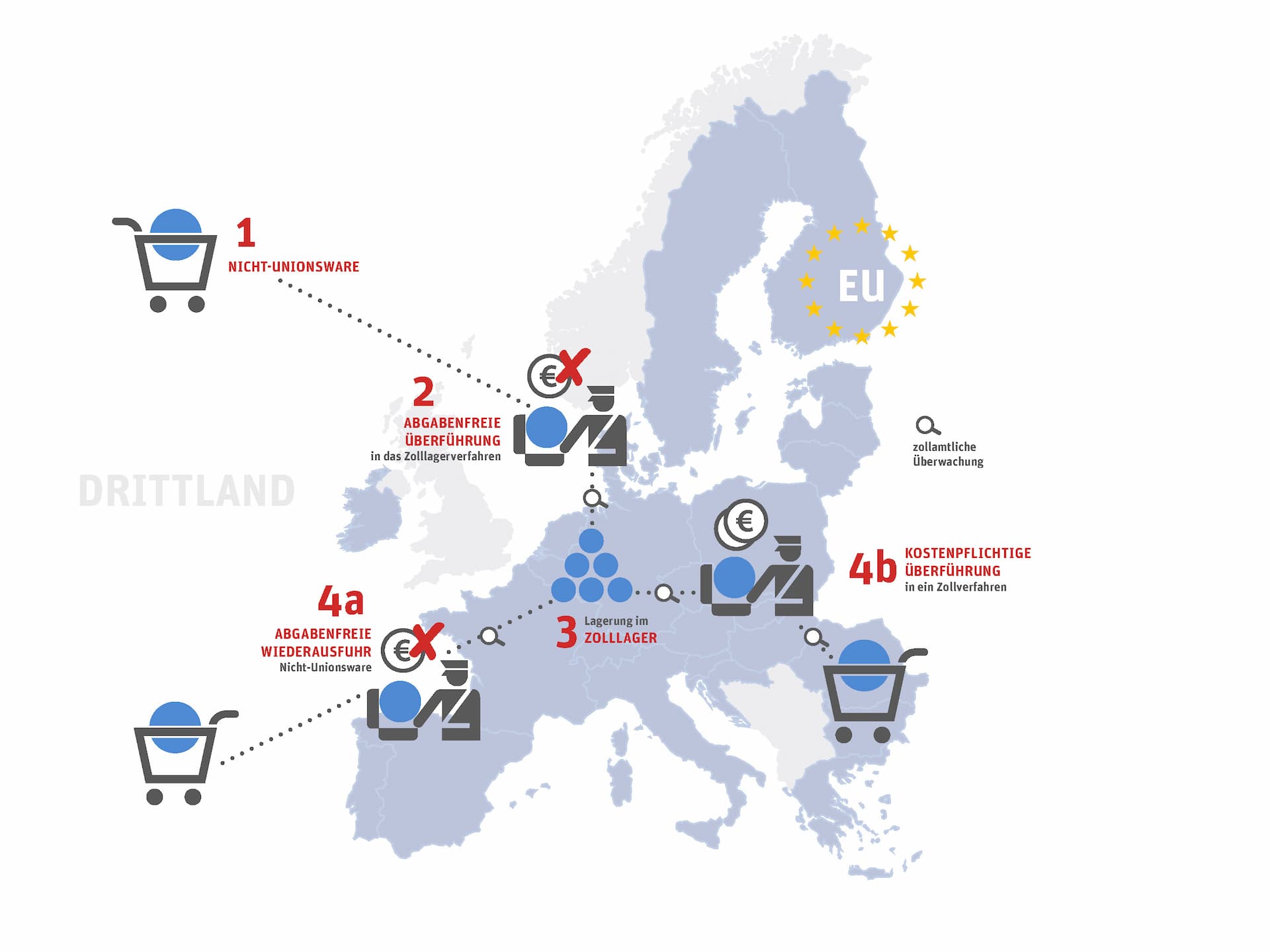

Damit Sie Ihre Zollprozesse rechtskonform durchführen und die Kommunikation mit den Behörden sicherstellen, brauchen Sie eine effiziente Lösung. Unsere Zollsoftware ist ATLAS-zertifiziert und erfüllt alle Anforderungen der Zollverwaltung. Durch einfache Oberflächen können alle Import- , Versand- und Exportvorgänge komfortabel erfasst werden. Selbstverständlich finden hier auch Themen wie IMPOST und ICS2 Sicherheitsanmeldungen Berücksichtigung. Und auch spezielle Verfahren wie Aktive Veredelung, Passive Veredelung oder Zolllager deckt die Software ab. Mit Anbindungen zu den deutschen Seehäfen, der Westhäfen und dem Airfreight Handling Tool ist Advantage Customs ideal für den Im- und Export über See- und Luftfracht.

The modular structure allows integration into your SAP or any other ERP system. Advantage Customs can also be combined with all other dbh products and thus becomes a platform for your customs and foreign trade.

Zollvorteile strategisch nutzen

Wirtschaftlichkeit innerhalb der Supply Chain ist nicht nur eine Frage der Frachtkosten oder der Einkaufspreise. Die Einsparpotenziale bei den zollrechtlichen Bestimmungen sind erheblich.

Sales tax reform 2020

We have compiled knowledge and background information on the sales tax reform 2020 for you.

Find out what to look out for in the future when trading goods in the Internal Market.

Origin of goods and preferences

Profitieren Sie von Zollvergünstigungen durch die Nutzung von Präferenzabkommen zwischen der Europäischen Union und einer ganzen Reihe von Drittländern und Handelszonen. Die Kunst ist, den Überblick über die wachsende Zahl von Präferenzabkommen, Freihandelsabkommen und den damit einher gehenden Regelungen zu behalten. Mit unserer Lösungen Advantage Compliance Präferenzmanagement bekommen Sie das Thema Warenursprung und Präferenzen (WUP) schnell in den Griff.

Management of supplier's declarations

Preferential calculation

Determination of the origin of goods

Präferenzkalkulation

Es bestehen Präferenzregelungen im Warenverkehr mit zahlreichen Ländern. Zollvergünstigungen wurden beispielsweise zwischen der Europäischen Union und den EFTA-Staaten, den Balkan-Ländern, aber auch Mexiko, Chile, Südafrika und Südkorea geschlossen. Profitieren Sie bei der Einfuhr von Zollfreiheit und vergünstigten Zollsätzen.

Wer sich bereits mit der Kalkulation von Präferenzen beschäftigt hat, kennt Aufwand und Komplexität. Hinzu kommt, dass Sie – wenn Sie Präferenzen kalkulieren – gesetzlich dazu verpflichtet sind, einen lückenlosen Nachweis des präferenzberechtigten Ursprungs in Form von Lieferantenerklärungen bei Handelswaren und vielen Verarbeitungsregeln zu führen.

FAQ origin of goods and preferences

In unseren FAQ zu Warenursprung und Präferenzen geben wir Ihnen einen Überblick über die wichtigsten Fragen zu diesem Thema.

Termine Warenursprung und Präferenzen

Lieferantenerklärungen

Wenn Sie Präferenzen kalkulieren, sind Sie gesetzlich dazu verpflichtet, einen lückenlosen Nachweis des präferenzberechtigten Ursprungs in Form von Lieferantenerklärungen bei Waren und vielen Verarbeitungsregeln zu führen. Einzel- und Langzeitlieferantenerklärungen können in Advantage Compliance Präferenzmanagement erfasst und verwaltet werden. Artikelnummern zu den Lieferantenerklärungen, Gültigkeitszeiträume und Präferenzabkommen werden standardmäßig dargestellt.

News from Customs & Foreign Trade

Brexit – Country codes Customs declarations

No official ATLAS Participant Information >/g> is yet available from the customs administration for the adaptations of the country codes in customs declarations for Great Britain, Northern Ireland and British Special Areas . The Federal Statistical Office has...

VAT reform: import procedure for small consignments under 22 euros

E-commerce has fundamentally changed retail. New suppliers from third countries are constantly offering their goods in the European Union. So far, these dealers have benefited from exemption limits for small shipments, because special tax exemption limits apply to...

Economic stimulus program: import sales tax due with a delay

In the context of the corona crisis, the federal government and the federal states have come to terms with a lot Stimulus package communicated. In addition to the reduction in sales tax from 19% to 16% (or from 7% to 5%), the change in the deadline for import sales...

EU-Vietnam Free Trade Agreement (EVFTA) enters into force

The free trade agreement (EVFTA) signed in Hanoi on June 30, 2019 will come into force on August 1, 2020. The aim is to significantly simplify imports and exports in order to benefit from Vietnam's strong economy. For Vietnam itself, this creates the opportunity to be...

Brexit: UK publishes customs tariff tool

There is still time until 31.12.2020 to conclude a free trade agreement between the EU and the UK (UK). Then the transition period for Brexitends. Boris Johnson continues to hold on to this date. It is not yet clear what will come next. Negotiations between the EU and...

Change in preferential proofof for EU exports to ESA countries

From 1 September 2020, eu exports to the ESA countries will receive preferential tariff treatment provided for in the Interim EPA only after making statements on the invoice. This applies to ESA countries as of 05.06.2020 (source) • exporters registered in the EU REX...

Your contact to dbh

You are interested in our products?

You have a question?

To find the right telephone contact person, you can find our overview here.