Advantage Compliance

Tariffs classification

Today, companies operating internationally have to comply with a variety of legal regulations and regulations. Part of this is the classification of goods in the customs tariff – the tariff. The customs tariff number can be used to derive the applicable customs and tax rates for the goods, as well as approval requirements. Classification errors can have serious and costly consequences. With Advantage Compliance Classification, you can easily find the right customs tariff numbers.

Benefits of classification

- Support in classifying your items

- Automatic updates of the product numbers (EZT)

- Interfaces to customs and foreign trade systems

- Management of set and assortment items

- Integration of data from existing ERP systems

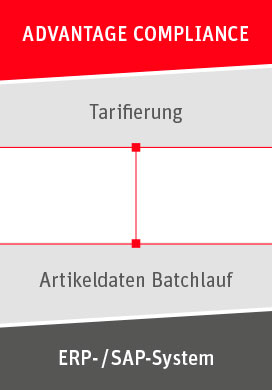

SAP and ERP Integration

dbh plug-ins for SAP are software extensions that allow you to easily add modules to your SAP system, such as sanctions list checks, export controls, tariff classification and US re-export controls. And your advantage: dbh SAP plug-ins are already designed for SAP S4/HANA.

Other ERP systems (merchandise management systems) can also be extended with Advantage Customs modules.

Request information now

Correct goods classification is necessary

Misclassification can have not only financial but also legal consequences. The digital audit plays with the recasting of Section 147, para. 6, Tax Code plays a crucial role in the need for the correct classification of goods. In addition to customs inspection, however, other financial and legal aspects are important.

What do you have to consider when classifying?

- Can preferences be used?

- Is the right amount of taxes and levies paid?

- Are there any prohibitions and/or restrictions?

- Do you need additional documentation?

- Does the import/export of an authorisation/licence require?

- Is the product subject to the anti-dumping regime?

Properly tariff with the dbh solution

The module is used for the sustainable documentation of the correctly determined product numbers. Item data can be read in via interface and assigned directly, the item master can be created internationally. The well-known content supplier guarantees always up-to-date data and automatic consideration of changes.

An editing wizard helps you create and rank new items. Set and assortment items can also be easily lined up and managed. When classifying comparable articles, the module displays suggestions. Classification offers several ways to determine the correct commodity tariff number: direct search in the goods nomenclature, browsing the keyword directory or crawling already classified items.The goods classification has interfaces to other dbh modules. Classified items can be transferred to export control, for example.dbh classification is an intelligent classification support. It can be implemented independently or into your existing Advantage Compliance System.

Your contact to dbh

You have a question?

You have a question? Then write us via our contact form.

Your contact to our sales department

Your contact to the dbh sales department

+49 421 30902-700 or sales@dbh.de

You are interested in our products and consulting or need help with your dbh software? Our sales team will advise you to find the perfect solution for your company.