Canada, Great Britain, Singapore, Vietnam… Finding your way through the document jungle:

What is the correct proof of preference when exporting?

The desire to be able to pass on the competitive advantage of “preferential imports” to the customer is great. But in many recent agreements EUR.1 are no longer possible. Here, it is mandatory for the exporting company to have an authorisation/registration in order to be able to submit a declaration of origin for shipments of 6,000 euros or more and thus be able to benefit from the trade agreements.

But for which country is which proof required – here is an overview!

Proof of preference for South Korea and Singapore

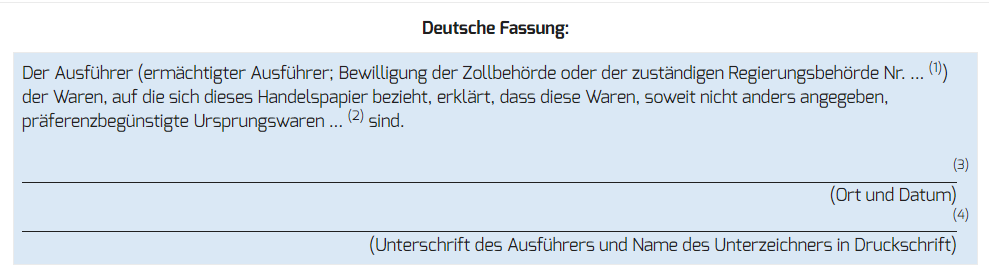

In the preferential agreements with Singapore and South Korea, only the declaration of origin on the invoice is agreed as proof of preferential originating status. For goods with a value of more than 6,000 euros, this requires an “approved exporter” authorisation! In order to obtain approval from the responsible main customs office, it is necessary to prepare and submit current work and organizational instructions. Information on how to apply for this authorisation can be found on the Customs Administration website at this link

Declaration of origin on the invoice

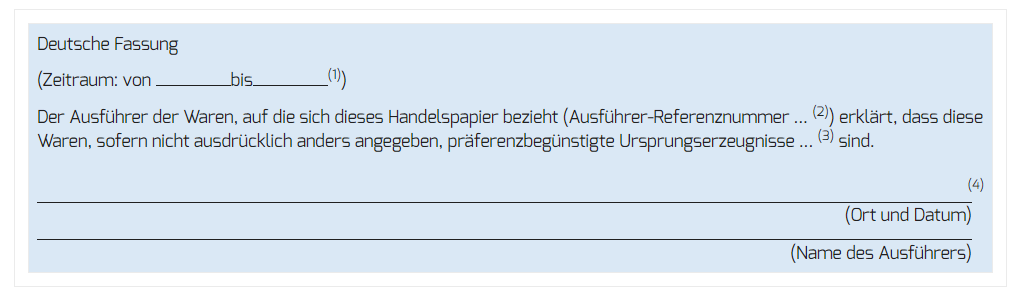

Proof of preference for Canada, Japan, United Kingdom, Côte d’Ivoire, Vietnam, Ghana and the ESA States

The prerequisite for preferential export to the countries listed here is the application for “Registered Exporter” status. This is not an authorisation from the main customs office, but only a registration in a database.

The application for registration as a REX must be submitted to the competent main customs office. The electronically fillable application form no. 0442, the use of which is obligatory, as well as detailed information on the registered exporter can be found in a leaflet of the customs administration.

Consequences for practice

Regardless of which declaration is the correct one for the transaction in question, it may only be issued for the export transaction in question if the goods meet the preferential origin requirement. Thus, it is a prerequisite that the processing rule for the article(s) has been checked according to the respective agreement (preferential calculation or existing preferential supplier’s declaration in the case of merchandise).

However, it is imperative for the use of these new agreements that the company processes are adapted in such a way that, depending on the receiving country, the correct declaration is selected in order to enable the customer to import at a reduced rate of duty in the receiving country.

At wup.zoll.de in the section “List of countries” you have the possibility to check what the declaration of origin is in the respective agreement.

Declaration of origin for export to the United Kingdom (UK)

Your contact to dbh

You have a question?

You have a question? Then write to us via our contact form.

Your contact to our sales department

Your contact to the dbh sales department

+49 421 30902-700 or sales@dbh.de

Do you use one of our products and need support? Our support team will be happy to advise you.