REX – Registered Exporter

What is a REX and how do you become that? Who has to become a registered exporter and how does the REX number build up?

We address these and other questions in our dbh knowledge.

What is a registered exporter?

REX stands for “Registered Exporter”. Registered exporters may independently provide proofs of origin in the form of a declaration of origin on the invoice, without the direct cooperation of the competent authorities. The REX procedure is provided for under a number of free trade agreements (Japan, Canada) and the European Union’s GeneralIsed System of Preferences (GSP).

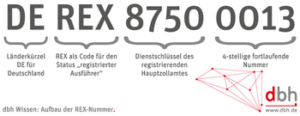

Structure of the REX number

The REX number (e.g. DEREX87500013) is as follows:

The REX number (e.g. DEREX87500013) is as follows:

Places 1 and 2: Country abbreviation DE for Germany

Places 3 to 5: REX as code for registered exporter status

Posts 6 to 9: Service key of the main customs office registering

Digits 10 to 13: 4-digit sequential number

The REX number must always be indicated in the form and specified spelling in the declaration as transmitted by the Main Customs Office. If the REX number is missing, the declaration of origin issued is incorrect from a formal point of view.

When does a German company have to register as a registered exporter (REX)?

In the following cases, eu exporters will in future demonstrate preference through the Declaration of Origin:

- Two-way trade agreements providing for the REX system: currently in the CETA agreement with Canada and in the ETA agreement with Japan

- Bilateral cumulation: EU originating goods are sent to a GSP country for further processing (with proof of preference) and then return to the EU with preference

- GSP originating goods are shipped by a re-consignor in the EU with a replacement proof of preference within the EU, Switzerland or Norway

The registered exporter in the export

Application to free trade agreements

In order for your customers to benefit from the preferential benefits under free trade agreements, the certificates of origin issued by you as an EU exporter must be able to be presented. The REX system is currently used in the following agreements:

- Canada (CETA)

Declaration of origin in accordance with Articles 18 and 19 i.V.m. Annex 2 to the protocol of origin on CETA. Since January 1, 2018, the REX has replaced the authorised exporter in this agreement. - Japan (EPA)

Declarations of origin under Article 3.17 in accordance with Annex 3-D to the Agreement

Declarations may be issued only if the goods to be exported have a preferential origin in accordance with the rules applicable in each agreement. Up to a value of 6,000 EURO in a consignment, declarations can be made out without registration. In addition, a levy is only possible by a REX.

Application in the EU Generalised System of Preferences (GSP)

Preferential EU certificates of origin are not granted a tariff preference in the beneficiary developing countries, so exporters are not likely to have to issue preferential certificates.

Only in the following cases will the GSP issue proof sedation of preferences in the EU:

- Bilateral cumulation with EU originating products (EU exporter as a supplier)

- Replacement proof of preference for the re-shipment of certificates of origin within the EU or to Switzerland / Norway

Detailed information on the obligations of the REX in these cases in the information sheet of registered exporters (REX) for exporters and re-consignors in the EU”

The REX in import

Where is the registered exporter (REX) used in free trade agreements?

Currently, the registered exporter (REX) is used in the CETA Free Trade Agreement with Canada and the EPA with Japan.

In order to apply for preferential tariff treatment, the importer must submit the declaration of origin to the customs authorities in accordance with the rules of the Agreement and, where appropriate, other documents.

For more information:

Application in the EU Generalised System of Preferences (GSP)

For imports from countries participating in the Generalised System of Preferences (GSP), the European Union grants a preference (tariff concession). Until 30 June 2020, the Registered Exporter will replace the previous issue of a Form A preference certificate for a value of goods starting at €6,000.

The respective countries have chosen three different start dates: 1 January 2017, 2018 and 2019. The transitional period in each country is one year. During the transitional period, the declaration of origin on the invoice (REX) and Form A will be recognised in parallel for 12 months. An extension of the transitional period by 6 months is possible on request.

After the transitional period, a duty-free/favourable effect is only possible with a declaration of origin of a REX. For countries that do not have a REX system in place until the end of the transitional period, there is no proof of origin recognised by the EU. Accordingly, it is no longer possible to import from these countries at reduced tariffs. They are therefore effectively excluded from the GSP. Subsequent application for the extension of the transitional period (1.1. to 30.06.2019) is possible. This would allow, at least for certificates of origin Form A, which have been issued inanimating manner in those countries since 1 January 2019, to be recognised in the context of a refund procedure.

What do importers need to check?

In principle, it is necessary to check which preference certificates are currently valid in the respective GSP country. The EU publishes the latest state of play on its pages on the REX system.

Under Article 102 of the UCC-IA,100 3 UCC-IA, in the case of imports from beneficiary countries, the customs declarant must then check whether the conditions for preferential granting are met before the goods are declared for release for free circulation for release for free circulation:

REX support in your customs software

With our customs software Advantage Customs we offer you the possibility to check your business partner directly in the customs software via the master data in the EU web portal. In addition, you will find the additional tab “Declaration of Origin” in the import err/WR. This helps you to properly encode your import transactions

- Explanation of origin is formally correctly explained:

The text of the declaration is derived from Annex 22-07 of Regulation (EU) 2015/2447 (UCC-IA). The declaration does not need to be signed. However, it must contain an indication of the origin criterion and the HS position of the goods delivered. If the foreign supplier uses an incorrect wording, this will result in no preference being granted: - Registered exporter number is correct.

The examination of the REX number should be documented.

For manual testing, master data are available in the EU web portal Available.

If the declaration is made without a valid REX number or if the number is incorrect, no preference is granted.

What should be considered when importing?

For the granting of a preferential duty under the GSP system, one of the following TARIC documentation codings shall be reported in the item of the relevant import customs declaration in addition to application code 2XX in the “Documents” box:

| ATLAS code | Importance |

| C 100 | Registered exporter number |

| U-164 | Declaration issued by a registered exporter… of no more than 6,000 € |

| U-165 | Declaration issued by a registered exporter… of more than 6,000 € |

| U-166 | From a unregistered exporter statement… of no more than 6,000 € |

| U 167 | From a unregistered exporter statement… of more than 6,000 € |

What is the difference between the authorised exporter and the registered exporter?

The authorised exporter shall be authorised by the Main Customs Office. The applicant is required to have extensive knowledge of the right of origin and to submit an organisational plan. Authorised exporters may issue declarations of origin on the invoice without a value limit, i.e. the normally required movement certificate EUR.1 or EUR-MED is not required. They are also allowed to issue goods certificates A. TR, which have been pre-handled in the eu-Turkey trade. Use. Advantage: the local customs office is no longer required for the issuance of proofs of origin – but of course the responsibility for transmitting the preferential origin lies solely with the exhibitor. The agreement with South Korea can practically only be used with the authorised exporter, because there is virtually no other evidence for goods values above EUR 6,000.

Collecting the data for the REX is a “simple” registration. In addition, no evidence of specific knowledge in the law of origin is required. Registered exporters are allowed to make declarations of origin on the invoice in different free trade agreements and in the EU GSP system, even if the value of goods exceeds EUR 6,000.

Important! Agreements in which the REX are preceded shall not allow the production of a declaration of origin on the basis of an existing authorisation as authorised exporter! Additional registration as a REX is required here.

Your contact to dbh

You have a question?

You have a question? Then write us via our contact form.

Your contact to our sales department

Your contact to the dbh sales department

+49 421 30902-700 or sales@dbh.de

You are interested in our products and consulting or need help with your dbh software? Our sales team will advise you to find the perfect solution for your company.