System of CO2 border adjustment levy on the import of certain groups of goods.

CBAM Carbon Border Adjustment Mechanism

The EU Green Deal aims to massively reduce emissions by 2030 and become climate neutral by 2050. One important measure for achieving the target is the Carbon Border Adjustment Mechanism (CBAM) initiative.

EU companies that import emissions-intensive goods(iron, steel, cement, aluminum, electricity, fertilizers, hydrogens, and certain upstream and downstream products in pure or processed form) into the EU are to buy CBAM allowances to make up the difference between the carbon price paid in the country of production and the higher price of allowances in the EU ETS. If it can be proven that a CO₂ price has already been paid for a product from a third country, the costs can be partially to fully credited to the CBAM certificate. CBAM thus aims to ensure that companies in the EU are not disadvantaged by unfair competition by bearing higher climate protection costs than competitors outside the EU. At the same time, countries around the world are to be motivated to introduce their own taxes and levies on emissions, which they can collect themselves

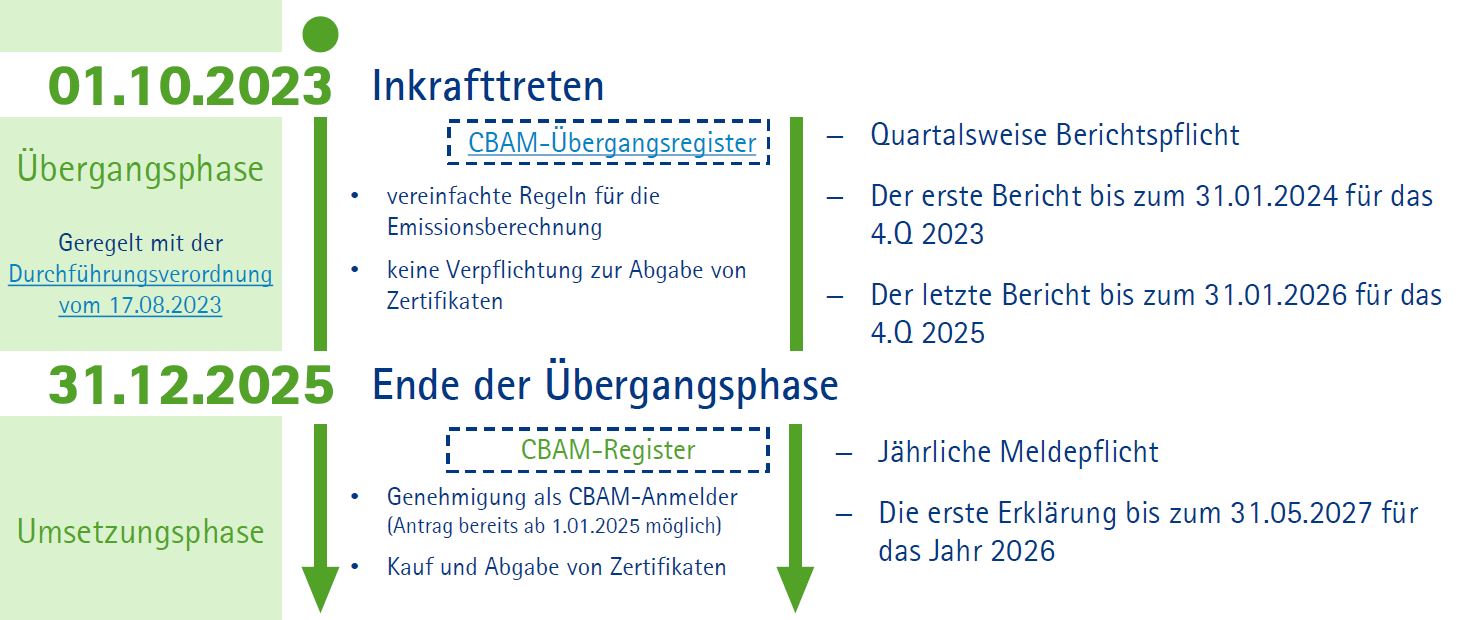

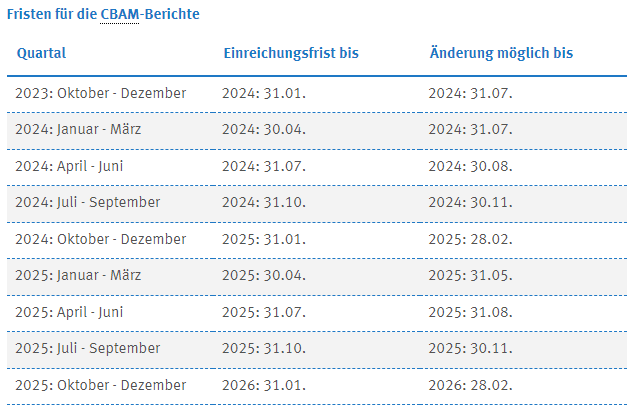

CBAM will be introduced in stages in accordance with the CBAM Implementing Regulation (published in the Official Journal of the EU on September 15, 2023):

Source: IHK Bodensee-Oberschwaben

Information in the customs declaration is not required during the transition period. The importer (customs declarant) or his indirect representative is obliged to report.

In the case of indirect representation, the representative assumes liability. Indirect representation should therefore only be used,

if the importer is not established in the EU and therefore does not have an EORI number. owns!

The submission of a CBAM declaration as a direct representative (classic import processing by a service provider) is not permitted!

We summarize the currently available information for you and keep you up to date. Many things are still unclear or not yet available.

How the EU explains CBAM

Source: taxation-custom.ec.europa.eu

Those who do their import processing with the dbh customs software Advantage Customs can already extract all customs-relevant data from the system and evaluate it in Excel.

Thus, all existing information of an import shipment can be configured and prepared appropriately for the CBAM report.

Which product groups are affected?

CBAM concerns the import of products listed in Annex I of Regulation (EU) 2023/956 listed goods. This currently means (the list is to be extended from 2026):

- Iron and Steel Chapter 72:

with the exception of certain products of heading 7202: 7202 2X, 7202 30, 7202 50, 7202 70-7202 9980 - Articles of iron or steel Chapter 73:

Items 7301, 7302, 730300, 7304-7311, 7318, 7326. - Aluminum and articles thereof Chapter 76:

7601, 7603-7614, 7616.

Excludes 7602 and 7615 - Iron ore 2601 1200

- Hydrogen 2804 1000

- Electricity 2716

- Cement: 2507 0080, 25231000, 25232100, 25232900, 25233000, 25239000

- Ammonia 2814

- Potassium nitrate 2834 21 00

- Fertilizers 28080000, 3102 and 3105

IMPORTANT:

If the commodity code / customs tariff number used for import in Annex I of the CBAM Regulation is not then the goods do not fall not under CBAM, regardless of whether it contains iron, steel or aluminum. This is relatively often the case with screws, for example.

What are the exceptions?

- Small consignments that are included in the Annex but whose total value per consignment does not exceed EUR 150.

- Goods for personal use.

- Goods with the countries and territories listed in Annex III Section A: currently Switzerland, Liechtenstein, Norway and Iceland.

- Goods originating in the EU and returning to the EU (returned goods)

CBAM only covers declarations for release for free circulation and – to avoid circumvention – also the inward processing procedure.

Phases of the introduction of CBAM

The CO2 border adjustment levy will be applied in full from 2026.

The transition period from 01.10.2023 is intended to serve this purpose, To gather data and experience and still readjust the final methodology. Financial compensation payments do not have to be made.

Transition phase 2023-2025

In the transition phase, no certificates with costs have to be purchased yet. Information in the customs declaration is not required during the transition period.

Since January 2024, however, the customs authority has implemented its duty to notify when importing CBAM goods: In EZT-online, TARIC measure type 775 with footnote TM 967 is linked to the respective customs tariff numbers for the goods covered by the CBAM Regulation. This footnote refers to the reporting obligations during the transition period.

However, a CBAM report must be submitted no later than one month after the end of the quarter. For the 4th quarter of 2023, an application for an extension of the submission deadline can still be submitted via the CBAM portal until March 31, 2024. The latest date for submission would therefore be the end of April.

The customs declarant or, if the declarant is not based in the EU, his indirect representative is responsible.

The provisional CBAM registry has now been activated. According to the EU Commission, access is to be activated by the national competent authority. A national authority was finally appointed in Germany on 29.12.2023. The German Emissions Trading Authority (DEHSt) at the Federal Environment Agency provides corresponding information on its website DEHSt border adjustment CBAM. The German Emissions Trading Authority explains the access portal on its website Transitional register and CBAM portal for entrepreneurs.

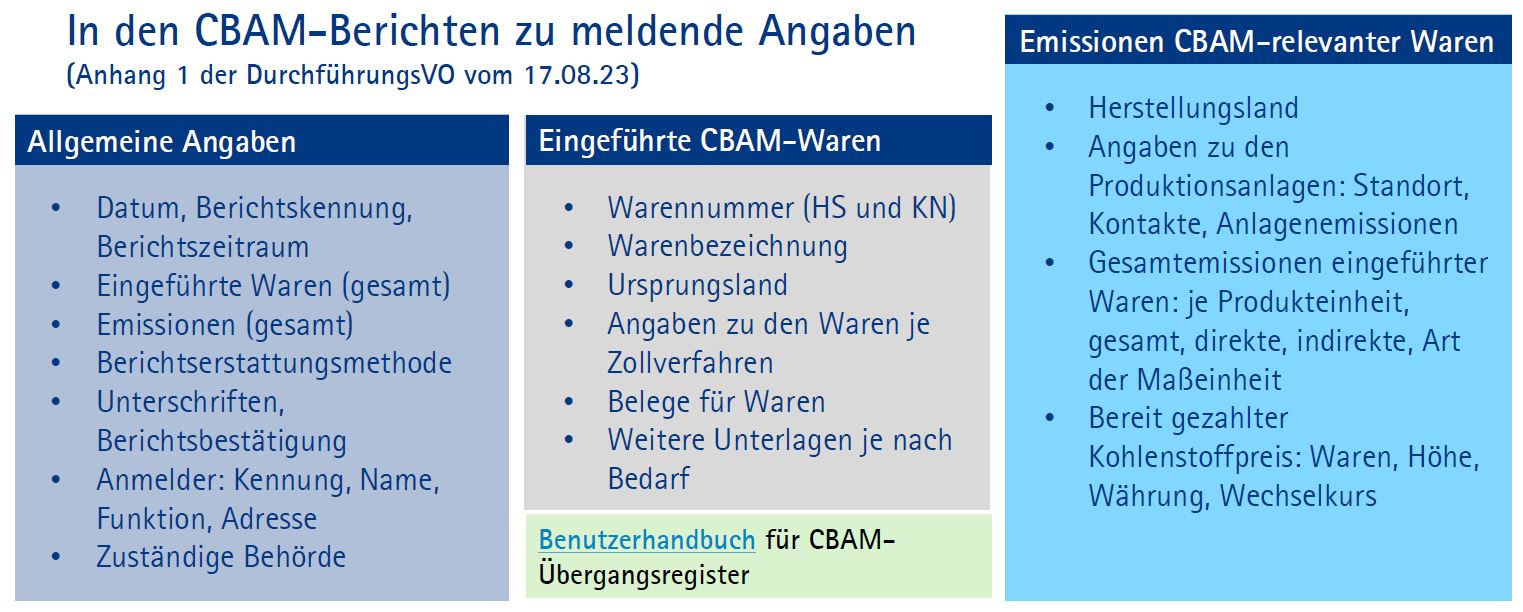

As part of the report, the direct and indirect emissions generated in the production process of the imported goods and the CO2 prices paid in the country of origin must be reported. This is only possible with the corresponding data from the foreign manufacturer. As an aid, the EU Commission has prepared guidelines for plant operators in third countries as well as an Excel template for querying within the supply chain. Article 4 of the Implementing Regulation lists the different calculation methods.

Estimates or default values are permitted for the transition phase. The EU Commission published corresponding standard values for this on 22.12.2023 . The default values are sorted by product group. They refer to the CN code of the goods and provide information on the direct and indirect as well as the total greenhouse gas emissions. They represent a global average, weighted by production volumes.

Source: IHK Bodensee-Oberschwaben

Implementation phase from 2026

- Apply for a CBAM filing authorization as an “approved filer” at the place of business. The goods concerned may then only be imported into the customs territory of the Union by “authorized declarants”.

- Calculation of embedded direct and indirect emissions of imported goods to the EU.

- Purchase the appropriate number of CBAM allowances from the relevant CBAM authority required to cover embedded direct and likely indirect emissions.

- Submission of an annual CBAM statement by 05/31. of each calendar year for the emissions associated with the goods imported in the preceding calendar year.

- Verification of the information in the CBAM declaration by an accredited verification body (currently still unclear who will be responsible for this).

How can you prepare now?

- Check if you are really affected!

CBAM is a topic for you if- you import one of the commodity codes listed in Annex I of the EU Regulation from countries outside the EU

- it is not a returned product from the EU

- the goods do not originate in Switzerland, Norway, Iceland, Liechtenstein or the EU.

For this, you need to know the non-preferential origin of your affected commodity codes.

- Determine who in the company is responsible for checking and complying with the reporting requirements.

- Make sure you know the non-preferential origin of the goods involved.

- Use the information and e-learning offers of the EU Commission to familiarize yourself with the topic.

Many chambers of commerce are also currently offering information seminars on CBAM(overview of dates).

dbh will also be offering an information webinar on 17.01.2024. - Compile imports by country of origin – and if known – by production site. Sit down with contact your suppliers regarding the calculation of CO2 emissions. Large foreign manufacturers are probably dealing with the issue, as all EU importers (will) approach them with this issue. If no values are available or the effort involved is unmanageable, default values can be used, at least during the transition period.

EU assistance for companies

To support practical implementation, the Commission has published fact sheets of a general nature as well as for the various product groups. The EU Commission provides also provides recordings of its webinars, which deal with the general characteristics of CBAM and the specifics of each sector. E-learning courses are also available ready.

The EU answers the most important questions about CBAM in its FAQ.

Information and a template are available for coordination with your suppliers:

Standard values were published on a product group basis for the transitional period.

Assistance from the German Emissions Trading Authority (DEHSt) for companies

We compile information on knowledge topics with the greatest possible care. However, dbh does not guarantee the completeness, accuracy and timeliness of the information, content and external links to third-party information provided.