Software for Customs & Foreign Trade

In order to participate in global trade, a sensibly networked IT infrastructure is indispensable. Finally, it is necessary to communicate with a number of other IT systems of different institutions and countries. This is the only way to meet the innumerable requirements of those involved in the process.

Modern customs clearance

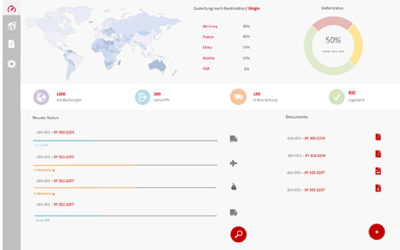

Advantage Customs is our solution for efficient and convenient customs and foreign trade management. Our software supports you with central functions of customs clearance. With interfaces to many international customs systems, Advantage Customs offers all the prerequisites for international customs traffic.

To participate in international trade, efficient and cost-effective customs clearance is essential. The digitalization of customs procedures simplifies the handling of import and export processes. Provided you have the right software to replace all written customs declarations and administrative acts with electronic messages. With Advantage Customs from dbh, customs clearance and customs processing becomes more efficient, faster and more profitable.

Keeping the overview in the jungle of customs regulations

With Advantage Customs, you have the right tool to carry out your customs processes in compliance with the law and ensure communication with the authorities. Our customs software is ATLAs certified and meets all requirements of the customs administration. Through simple interfaces, all import and export processes can be conveniently recorded. With connections to German seaports, western ports and the Airfreight Handling Tool, Advantage Customs is ideal for import and export via sea and air freight.

The modular structure allows integration into your SAP or any other ERP system. Advantage Customs can also be combined with all other dbh products and thus becomes a platform for your customs and foreign trade.

Sales tax reform 2020

We have compiled knowledge and background information on the sales tax reform 2020 for you.

Find out what to look out for in the future when trading goods in the Internal Market.

Origin of goods and preferences

Benefit from tariff concessions by taking advantage of preferential agreements between the European Union and a whole range of third countries and trade zones. With our Advantage Compliance Präferenzmanagement solutions, you can quickly get to grips with the issue of product origin and preferences (origin of gods & preferences).

Management of supplier's declarations

Your content goes here. Edit or remove this text inline or in the module content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

Preferential calculation

Your content goes here. Edit or remove this text inline or in the module content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

Determination of the origin of goods

Your content goes here. Edit or remove this text inline or in the module content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

Preferential calculation

Anyone who has already dealt with the calculation of preferences knows the effort and complexity involved. In addition, if you calculate preferences, you are legally obliged to provide complete proof of preferential origin in the form of supplier’s declarations for commercial goods and many processing rules.

Supplier Declarations

When calculating preferences, you are legally obliged to provide complete proof of preferential origin in the form of vendor declarations for goods and many processing rules. Single and long-term supplier declarations can be entered and managed in Advantage Compliance Präferenzmanagement. Article numbers for vendor declarations, validity periods and preferential agreements are displayed as standard.

Customs News

Track & Trace: CargoTrace becomes order portal

Freight forwarders can now present customers and their agents the status of their international shipments more up-to-date and clearer. With the new CargoTrace portal, dbh offers not only additional display options, but also the possibility to record forwarding orders...

ATLAS participant info 3711/19 of 22.11.2019

This document has been published by THE ITZBund:Lorem ipsum dolor sit amet Your contact to dbhSie haben eine Frage? Dann schreiben Sie uns über unser Kontaktformular.Your contact to the dbh sales department +49 421 30902-700 or sales@dbh.deYou are interested in our...

ATLAS participant info 3706/19 of 21.11.2019

ATLAS – Participant Info 0026/20

Atlas Zelos: New customs platform facilitates data exchange

According to the World Bank's Logistics Performance Index, Germany has the most efficient customs clearance. This puts German customs in first place, ahead of Sweden and Japan. The Customs Administration has developed the new ATLAS-ZELOS IT system to ensure that this...

ATLAS Participant Info 0034/20

ATLAS Participant Info 0032/20

ATLAS Participant Info 0030/20

ATLAS Participant Info 0026/20

Corona: What should be considered in customs and foreign trade?

Zollabwicklung In the local customs offices there are concepts for maintaining the operation of the service, so that there are currently no restrictions on customs clearance. However, in order to ensure that the smoothest possible process is carried out, customs...